are federal campaign contributions tax deductible

Each of the types of deductions has subcategories such as charitable contributions student loan interest and capital losses. The federal government imposes a 765 payroll tax on the first 147000 of income and then 145 thereafter.

Do I Qualify For New 300 Tax Deduction Under The Cares Act

You can obtain these publications free of charge by calling 800-829-3676.

. Individuals may donate up to 2900 to a candidate committee per election 5000 per year to a. Today about 4 percent of taxpayers check that box. It doesnt matter if it is an individual business or other organization making the donation the campaign contribution is not deductible.

OPM sent out a message that states. And businesses are limited to deducting only a portion. The federal contribution limits that apply to contributions made to a federal candidates campaign for the US.

You cannot deduct contributions made to a political candidate a campaign committee or a newsletter fund. Campaign committees for candidates for federal state or local office. While tax deductible CFC deductions are not pre-tax.

Individuals can contribute up to 2800 per election to the campaign committee up to 5000 per year for PAC and up to 10000 per year for local or district party committees. Federal law does not allow for charitable donations through payroll deduction CFC or any other payroll deduction program to be done pre-tax. Resources for charities churches and educational organizations.

Even this far out presidential candidates are already in a fundraising frenzyHillary Clinton raised 28 million in the past three months aloneand the numbers are. The Combined Federal Campaign CFC is one of the largest and most successful workplace fundraising campaigns in the world. In 2016 the fund disbursed only 3474862.

The Commission maintains a database of individuals who have made contributions to federally registered political committees. Are campaign contributions tax deductible in 2019. The current fund balance is 369168988.

Political contributions arent tax deductible. The Combined Federal Campaign CFC makes automatic deductions from your salary each pay period and sends your gift to your chosen organization or cause within the CFC donation list. Resources for social welfare organizations.

Resources for labor and agricultural organizations. Search an individual contributor by their last andor first name. The following materials discuss the federal tax rules that apply to political campaign intervention by tax-exempt organizations.

Consider the Presidential Election Campaign Fund. A state can offer a tax credit refund or deduction for political donations. A tax deduction allows a person to reduce their income as a result of certain expenses.

Generally individuals cant deduct business entertainment expenses until the 2026 tax year thanks to tax reform. Donors who are eligible to itemize charitable contributions on income tax returns may include contributions made through the CFC. The example above comparing contributions to.

According to OPM you can deduct even if you take the standard deduction and do not itemize. Data on individual contributors includes the following. While tax deductible CFC deductions are not pre-tax.

There are five types of deductions for individuals work. WRONG for 2020. Reliance on Tax Exempt Organization Search.

A tax deduction allows a person to reduce their income as a result of certain expenses. A deduction for a contribution to a Canadian organization is not allowed if the contributor reports no taxable income from Canadian sources on the United States income tax return as described in Publication 597 PDF. Resources for business leagues.

With the election about to ratchet up into high gear people on both sides of the aisle have started donating to political campaigns. You cant deduct contributions of any kind cash donated merchandise or expenses related to volunteer hours for example to a political organization or candidate. Federal law does not allow for charitable donations through payroll deduction CFC or any other payroll deduction program to be done pre-tax.

The following are examples of the various types of contributor searches that may be conducted. Tax-deferred refers to income tax only. In Minnesota a registered voter can claim a Political Contribution Refund equal to her donation to a state.

There are five types of deductions for individuals work-related itemized education healthcare and investment-related deductions. Except as indicated above contributions to a foreign organization are not deductible. Contributions or donations that benefit a political candidate party or cause are not tax deductible.

After years of public service federal retirees may want to continue giving. Can I deduct campaign contributions on my federal income taxes. Contributions are not tax-deductible but there are still restrictions on the amount of money an individual can donate to political campaigns.

And since all participating recipients are 501c3 organizations you will enjoy a combined federal campaign tax deduction. You can obtain these publications free of charge by calling 800-829-3676. On federal tax forms taxpayers can check a box to direct 3 to the fund the sole source of public money for presidential campaigns.

Deductible Or Not A Tax Guide A 1040 Com A File Your Taxes Online Business Tax Tax Write Offs Business Bookeeping

Are Political Contributions Tax Deductible Smartasset

Are My Donations Tax Deductible Actblue Support

Which Charitable Contributions Are Tax Deductible Infographic Turbotax Tax Tips Videos

Are Political Contributions Tax Deductible H R Block

Are Political Contributions Tax Deductible Anedot

Tax Deductible Donations Can You Write Off Charitable Donations

Are Political Contributions Tax Deductible Smartasset

:max_bytes(150000):strip_icc()/not_for_profit_nonprofit_charity_AdobeStock_93906620-2ce63147cc814bd3b25984ee637c3bac.jpeg)

Charitable Contributions Tax Breaks And Limits

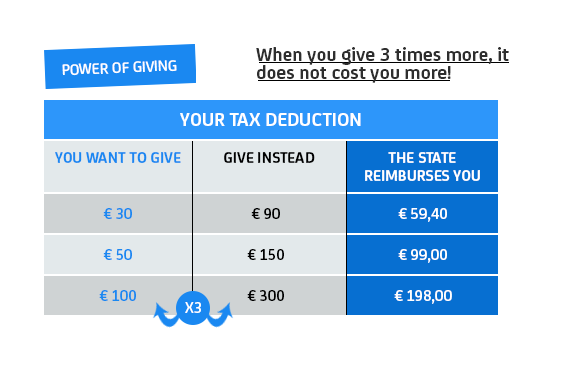

Tax Deductions For Donations In Europe Whydonate

Are Your Political Contributions Tax Deductible Taxact Blog

Are Political Contributions Tax Deductible Smartasset

Tax Deductible Donations Institut Pasteur

Are Political Contributions Tax Deductible Turbotax Tax Tips Videos